To find out if now is the time to buy, check out this week’s mortgage highlights:

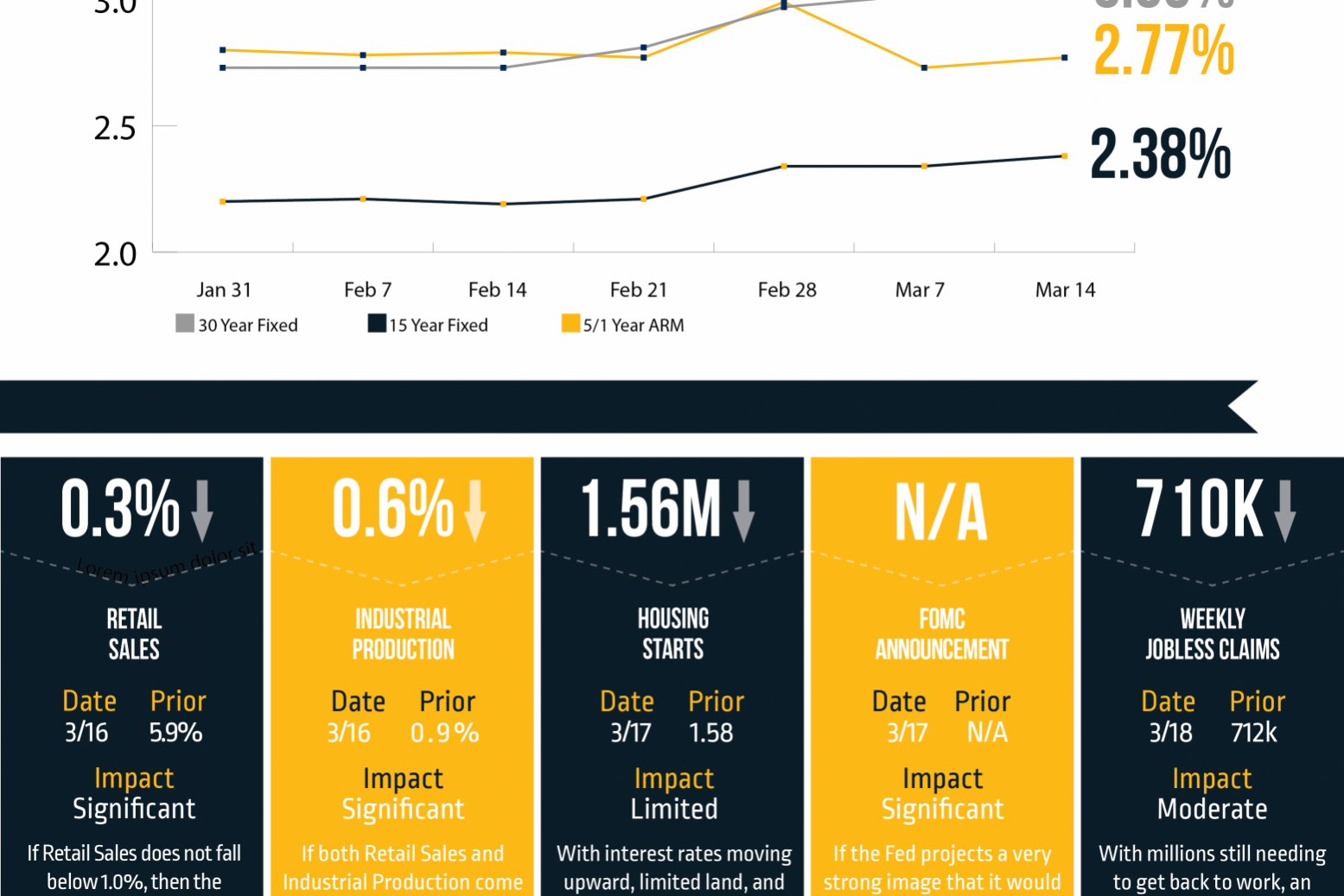

Mortgage rates continued to move slowly upward as current economic conditions and the outlook for future economic growth continue to improve.

With the passage of the next round of stimulus, some experts are expressing growing concern for future inflation. However, core inflationary readings are still well below the level the Fed wants to see.

The big unanswered question is how some of these massive trends will collide. We’ve got unprecedented levels of government spending, which means increased government borrowing, combined with an economy that very likely will accelerate as the virus-related restrictions loosen. Will this cause inflation to spike quickly, or will it remain tame?

The Fed meets this week, and we’ll get some deeper insight into its members’ thinking.

Should more than one of the governors predict interest rate increases in 2022, we are very likely to see mortgage rates rising.

That could be exacerbated if the post-meeting press conference highlights that the Fed is very comfortable with letting inflation run much hotter than experts are currently predicting.

No House. No Equity Gain

During the Great Recession, many renters may have felt a sense of relief as they watched foreclosures rise and friends struggle with homes worth less than their mortgage. However, that has changed. According to CoreLogic, the average homeowner saw their equity increase an average of $26,300 over the last year. Many renters are now actively working toward homeownership.